The Of Medicare Advantage Agent

An outside review is executed by an outside testimonial organization contracted by the Massachusetts Workplace of Client Defense. You need to ask for an outside allure from the Massachusetts Workplace of Client Protection within four months of receiving the decision on your internal charm. Your internal appeal notification ought to give the form to ask for an external evaluation and various other information regarding requesting an outside testimonial.

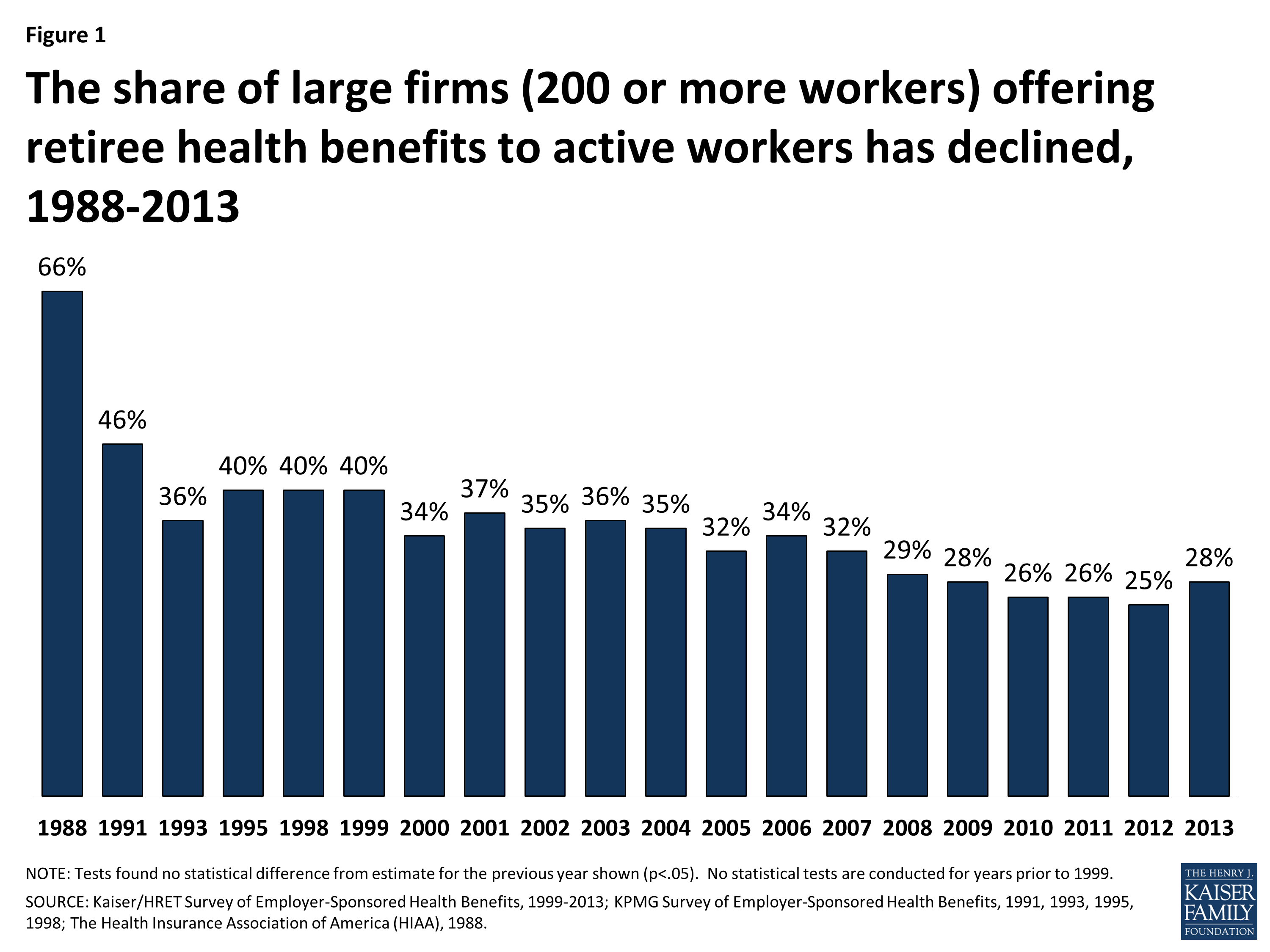

Health and wellness insurance policy regularly places as one of the most vital benefits among staff members and work hunters alike. Providing a team health insurance can assist you keep an affordable advantage over various other companies especially in a tight task market. When workers are stressed about exactly how they're mosting likely to handle a medical problem or pay for it - they can come to be stressed and distracted at the office.

It likewise provides them satisfaction recognizing they can manage care if and when they need it. Medicare Advantage Agent. The decision to provide worker health and wellness benefits usually comes down to an issue of expense. Many small service proprietors forget that the premium the amount paid to the insurance provider each month for protection is normally shared by the company and workers

Unknown Facts About Medicare Advantage Agent

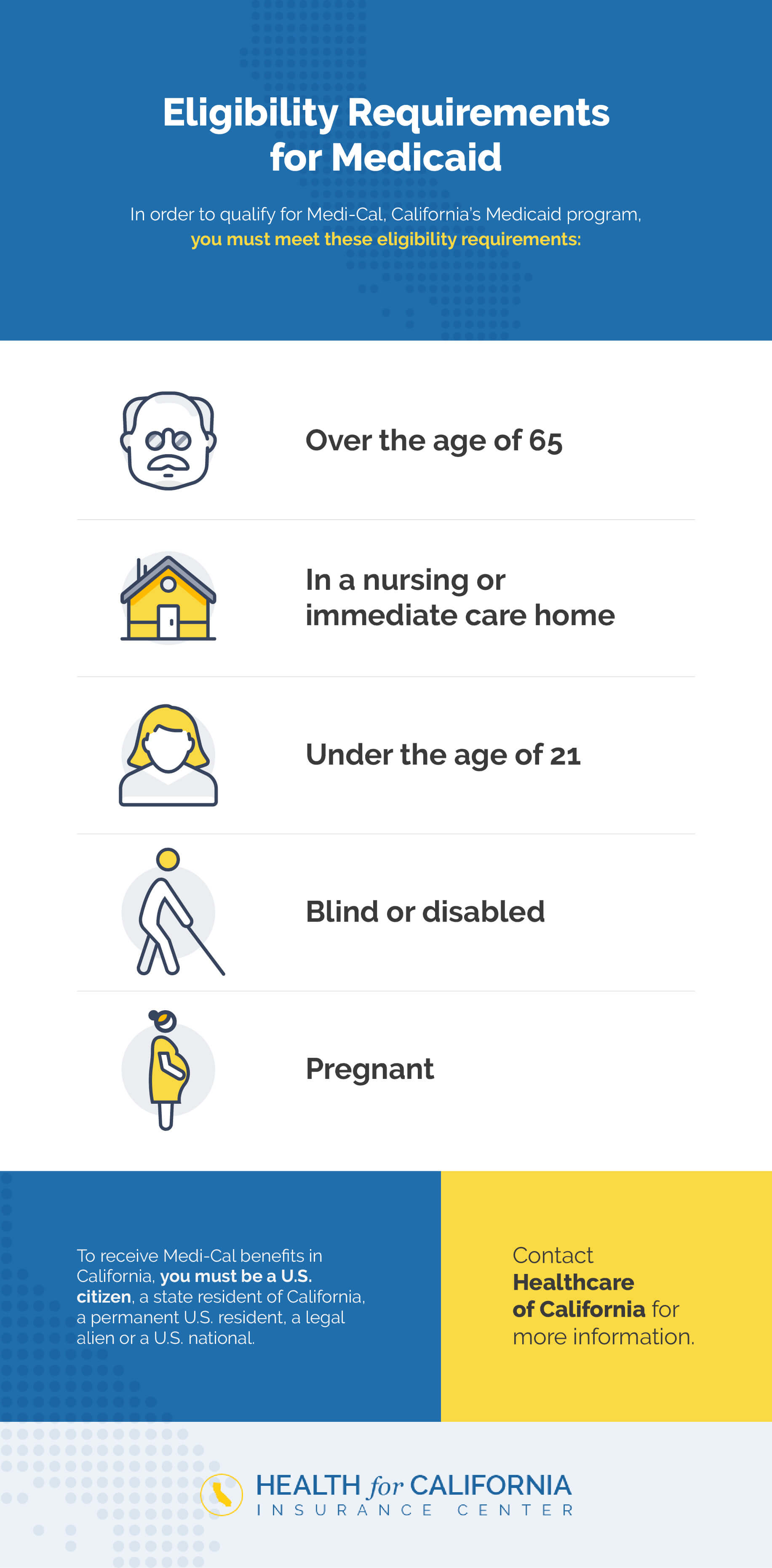

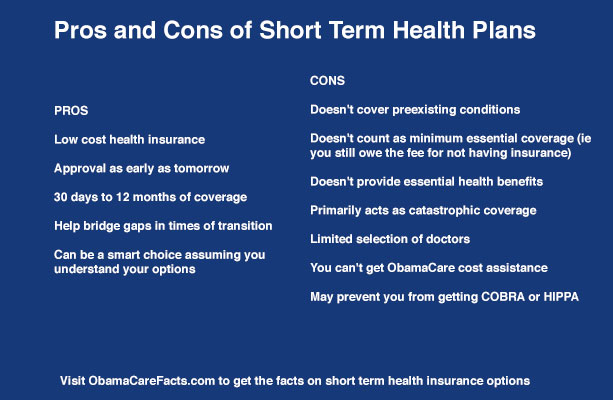

These choices can include medical, oral, vision, and a lot more. Discover if you are qualified for insurance coverage and sign up in a strategy through the Industry. See if you are qualified to use the Health Insurance coverage Industry. There is no earnings limit. To be qualified to register in wellness coverage via the Market, you: Under the Affordable Treatment Act (ACA), you have unique patient security when you are insured via the Wellness Insurance Industry: Insurance firms can not decline insurance coverage based upon gender or a pre-existing problem.

No one prepares to get truly sick or pain. If you purchase health insurance coverage, it can quickly cost you less money than going to the healthcare facility without it.

Health insurance still costs cash and picking the appropriate plan for you can be difficult. Medicare Advantage Agent. What if you already have insurance coverage?

Discover concerning the kinds of benefits to anticipate when you have health and wellness insurance. Find out much more concerning the price of health and wellness insurance consisting of things like co-pays, co-insurance, deductibles, and costs.

4 Easy Facts About Medicare Advantage Agent Explained

It will certainly sum up the essential functions of the strategy or insurance coverage, such as the covered benefits, cost-sharing provisions, and insurance coverage limitations and exemptions. People will get the recap when shopping for coverage, registering in protection, at each new plan year, and within 7 organization days of requesting a copy from their medical insurance issuer or team health and wellness strategy.

Thanks to the Affordable Treatment Act, customers will certainly additionally have a brand-new resource to aid them comprehend several of the most typical however confusing jargon made use of in health and wellness insurance (Medicare Advantage Agent). Insurance business and team health plans will certainly be needed to make offered upon request an uniform glossary of terms typically used in health and wellness insurance policy coverage such as "deductible" and "co-payment"

Health and wellness Get the facts insurance policy in the U.S. can be confusing. Numerous people don't have access to excellent protection they can afford, and numerous individuals don't have any health and wellness insurance at all. There are a lot of broad view changes that the federal government requires to make to make sure that medical insurance functions much better.

Some Of Medicare Advantage Agent

"Sometimes insurer also make adjustments to benefits in terms that are normally applicable upon revival of the plan, and so you wish to see to it that you're reviewing those and you recognize what those modifications are and how they might influence you," Carter says. It's likewise worth checking your benefits if your health and wellness has transformed recently.

"If customers can just make the testimonial of their wellness insurance coverage plan a conventional method, it's something that ends up being much easier and simpler to do gradually," claims Carter. Exactly how much you utilize your medical insurance relies on what's going on with your health. An annual physical with your main treatment medical professional i was reading this can keep you up-to-date with what's taking place in your body, and give you a concept of what sort of health and wellness treatment you may need in the coming year.